Understanding financial inclusion

Definition and importance

Financial inclusion refers to the availability and equality of access to financial services. It signifies the importance of providing affordable, appropriate, and accessible financial products to all individuals and businesses, particularly the underserved and unbanked populations. Financial inclusion aims to promote equitable access to financial services such as savings, loans, insurance, and payments, enabling individuals to participate fully in the economy, improve their quality of life, and contribute to sustainable economic growth.

Challenges faced by underbanked populations

Underbanked populations often encounter barriers to accessing traditional banking services and credit, primarily due to insufficient credit history, inadequate documentation, or geographical and socio-economic factors. These challenges include high transaction fees for essential financial services, minimum balance requirements, and the absence of banking facilities in their communities, making it difficult for them to secure financial stability and growth.

Installment lending overview

Definition of installment loans

Installment loans are a type of loan that is repaid over time through a series of scheduled payments. Unlike payday loans, which require full repayment on the borrower’s next payday, installment loans allow for a repayment plan spread over months or years, providing a more manageable and structured way to access credit.

History and evolution

Installment lending has a storied history, tracing back to the early 20th century as a way to make consumer goods and services more accessible to the average person. Over time, it has evolved to include various forms of credit, such as auto loans, personal loans, and mortgages, becoming a fundamental part of the financial systems and offering a vital credit option for consumers worldwide.

Benefits of installment lending for financial inclusion

Accessibility

Installment loans offer a more accessible credit option for individuals with limited credit history or lower credit scores, serving as a critical financial tool for those often excluded from traditional banking services.

Predictability and budgeting

The structured repayment plan of installment loans provides predictability. It helps borrowers budget and manage their finances more effectively, reducing the stress and uncertainty of other high-cost, short-term loans.

Credit building

Timely payments of installment loans are reported to credit bureaus, contributing to building a borrower’s credit history. This is crucial for enhancing their financial profile and increasing access to better financial products.

Regulatory landscape and consumer protection

Compliance with regulations

Installment lending is governed by a mix of state and federal regulations, including the Truth in Lending Act (TILA) and the Fair Debt Collection Practices Act (FDCPA), ensuring that these loans are safe and transparent consumer credit options.

Consumer protections

Consumer protections in installment lending are critical to preventing predatory lending practices, ensuring that loans are designed with the borrower’s ability to repay, and providing safeguards against excessive fees and interest rates.

Case studies and real-world examples

Success stories

Numerous examples exist where installment lending has helped individuals and families achieve financial stability, from enabling essential purchases that support economic activity to consolidating debt into more manageable payments.

Comparative analysis

Compared to payday loans, installment loans often come with lower APRs and longer repayment terms, making them a more sustainable and less predatory option for borrowers needing short-term credit.

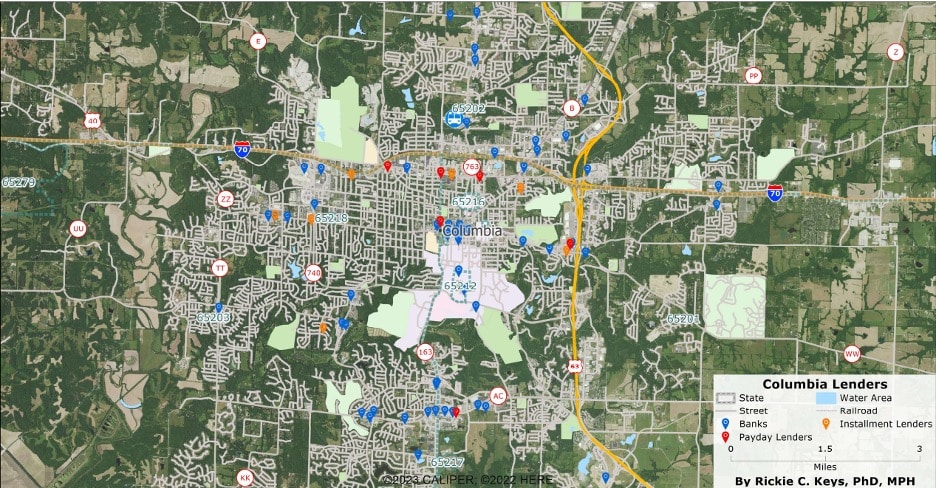

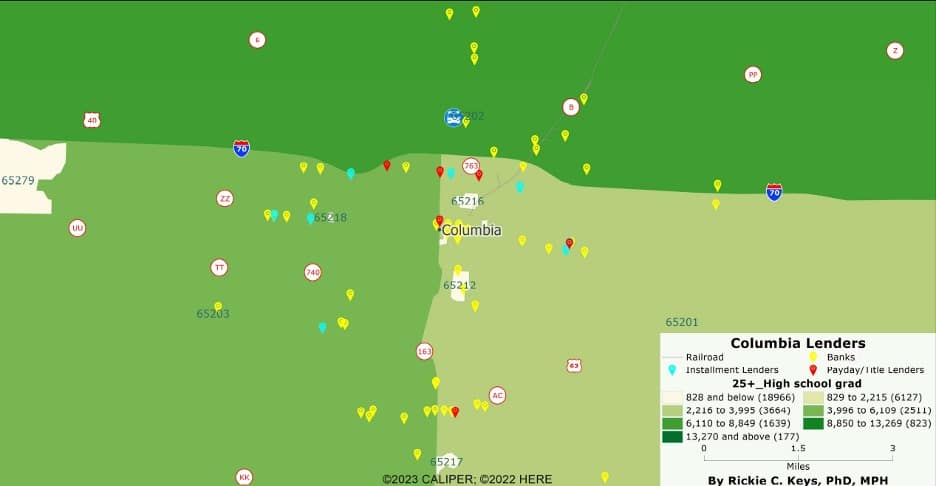

Columbia, Missouri, is a city that mirrors the complex dynamics of financial accessibility and inclusion across the United States. With a detailed analysis of the city’s financial services landscape, it becomes evident that while traditional banks are prevalent, a significant portion of the population depends on alternative financial services, including installment and payday lenders. This scenario presents a unique opportunity to enhance financial health and inclusion through the strategic use of installment lending.

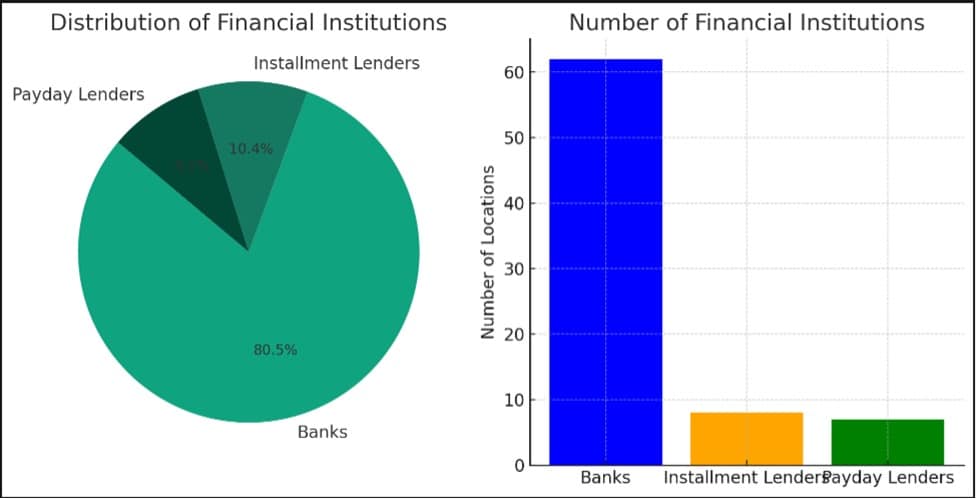

Overview of financial services in Columbia, MO

The financial ecosystem in Columbia boasts 62 bank locations, indicating a solid infrastructure for conventional banking services. These institutions provide various services, from savings accounts to mortgages, catering to a broad spectrum of the city’s population. However, alongside these banks operate eight installment lenders and seven payday lenders, highlighting a demand for alternative financial services. This mix of financial service providers points to a diverse need within the community, where not everyone can access or benefit from traditional banking solutions.

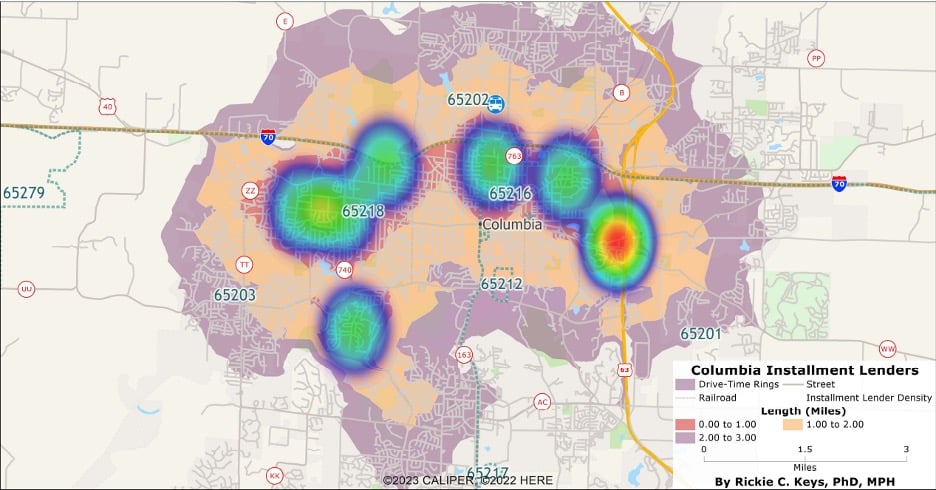

The importance of installment lenders

Installment lenders serve as a critical bridge for individuals who find themselves outside the purview of traditional banking due to various barriers, such as creditworthiness or the need for more flexible lending options. Unlike payday loans, installment loans offer a more structured and potentially less costly borrowing option, with longer repayment terms that can align better with borrowers’ financial capacities.

To fully grasp the opportunities for enhancing financial health in Columbia, MO, we turn to data visuals that succinctly communicate the current state of financial services distribution. These visuals will include:

- Pie Charts to illustrate the dominance of traditional banking services juxtaposed with the presence of alternative lenders.

- Bar Charts that compare the number of locations for banks, installment lenders, and payday lenders, highlighting the relative scarcity of accessible lending options for those outside the traditional banking system.

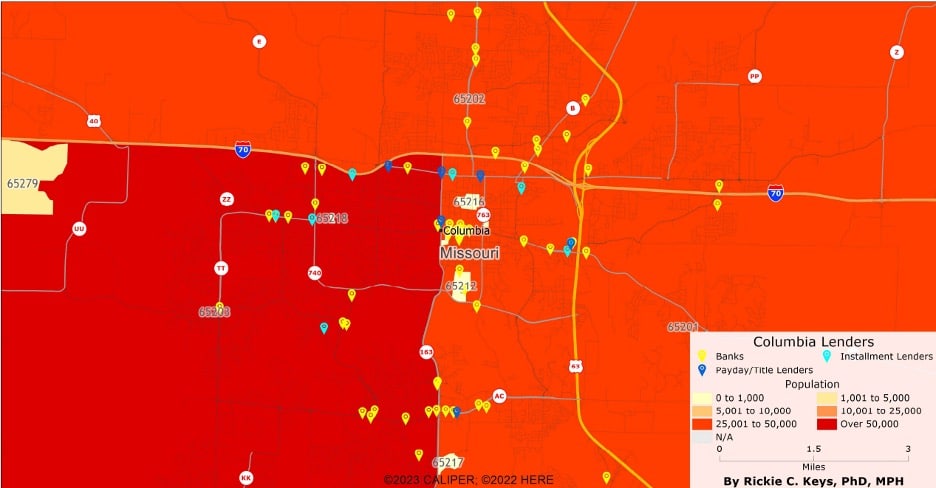

Population density map

This map will showcase the distribution of Columbia, MO’s population, highlighting densely populated areas versus those with lower population densities, setting the stage to understand how the availability of financial services correlates with where people live.

The population density map reveals the concentration of residents across Columbia, MO, providing a foundational perspective on potential demand for financial services and identifying populous areas that may benefit from increased financial inclusion efforts.

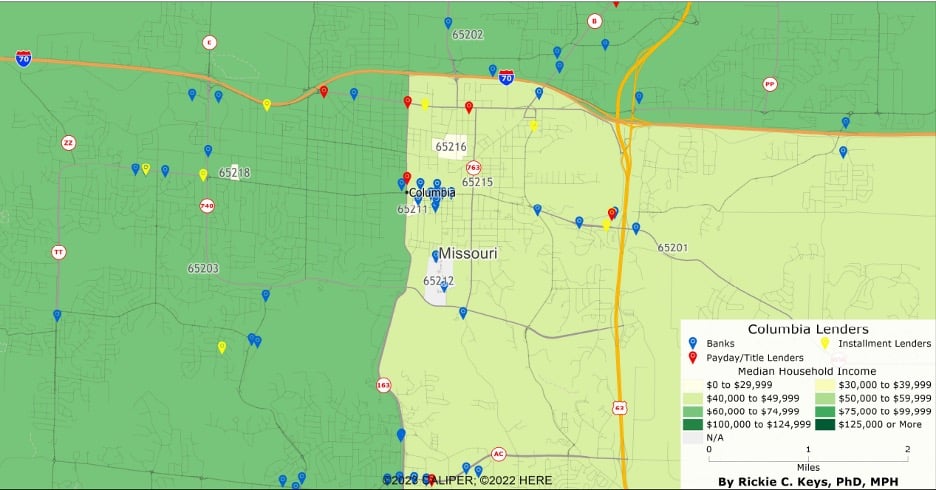

For the median income map

This map focuses on the median income levels across different areas of Columbia, MO, aiming to pinpoint economic disparities and identify communities that might be underserved by traditional banking institutions.

By visualizing median income variations across Columbia, MO, this map highlights economic divides, underscoring the importance of tailored financial services to support areas with lower median incomes in accessing affordable credit and banking solutions.

For the education level map

This map will delineate areas within Columbia, MO, based on education levels, offering insights into the educational attainment of different communities and its potential impact on financial literacy and access.

The education level map illustrates the distribution of educational attainment across Columbia, MO, shedding light on the correlation between education and financial service needs, potentially guiding targeted financial education and inclusion strategies.

Columbia’s financial services landscape reveals a robust banking infrastructure and underscores the critical need for alternative lending solutions like installment loans. By expanding the accessibility and visibility of installment lending, particularly in areas with fewer banks or higher economic vulnerability, Columbia can make strides towards reducing reliance on high-cost payday loans and improving overall financial wellness.

Challenges and criticisms

Interest rates and fees

Critics of installment loans often point to their interest rates and associated fees, arguing that they can still be high and potentially burdensome for some borrowers.

Potential for debt cycles

While installment loans offer a more manageable repayment structure, there is still a risk of borrowers entering a cycle of debt if they take on loans they cannot afford to repay.

Future of installment lending in financial inclusion

Innovations and fintech

Location-based access, technological advancements and fintech innovations are making installment loans more accessible and efficient, offering new ways to assess creditworthiness and provide credit to underserved populations. The following shows how identifying consumer need will substantially improve access to this vitally needed service.

Policy Recommendations

To optimize the positive impact of installment lending on financial inclusion, especially in contexts similar to Columbia, MO, the following policy recommendations are proposed:

- Enhance Regulatory Frameworks: Strengthen state and federal regulations to protect consumers from predatory lending practices while supporting the growth of installment lending as a safe and affordable credit option. This includes revising interest rate caps to ensure they are fair and not inadvertently limit access to credit for low-income individuals.

- Promote Financial Literacy: Implement community-based financial education programs focusing on building financial literacy, emphasizing the importance of credit, managing debts effectively, and the differences between various credit products. This initiative should target areas with high population densities and lower median incomes or education levels, as the data visuals and maps identified.

- Encourage Technology and Innovation: Support fintech innovations that aim to make installment loans more accessible and affordable. Encourage partnerships between traditional financial institutions, installment lenders, and fintech companies to develop products that cater to the needs of underbanked populations, leveraging technology to assess creditworthiness more holistically.

- Expand Access to Credit Building Tools: Advocate for installment lenders to report timely payments to credit bureaus, enabling borrowers to build or improve their credit scores. Policies should also encourage the development of new credit scoring models that consider alternative data, making it easier for individuals with limited credit history to access credit.

- Facilitate Community Banking Initiatives: Support the establishment of community banks and credit unions that can offer installment lending products, particularly in areas with fewer banking facilities. These institutions should be encouraged to collaborate with local organizations to address specific community needs.

- Monitor and Evaluate Lender Practices: Implement regular monitoring and evaluation of installment lending practices to ensure they remain fair, transparent, and aligned with consumer protection standards. This includes assessing the impact of installment loans on borrowers’ financial health over time to identify areas for policy improvement.

Conclusion

The analysis of the financial services landscape in Columbia, MO, underscores the critical role of installment lending in bridging the gap between traditional banking services and the needs of underbanked populations. By offering a more accessible, predictable, and credit-building form of borrowing, installment loans represent a crucial tool in the broader strategy to enhance financial inclusion. However, realizing their full potential requires a concerted effort from policymakers, financial institutions, and community organizations to create a regulatory environment that promotes fairness, innovation, and consumer protection.

Through targeted policy recommendations and ongoing commitment to financial education and inclusivity, installment lending can significantly contribute to financial stability and resilience for all individuals, particularly those in underserved communities. By addressing the challenges and leveraging the opportunities presented in the evolving landscape of financial services, we can work towards a more inclusive financial system that supports the economic well-being of every community member.