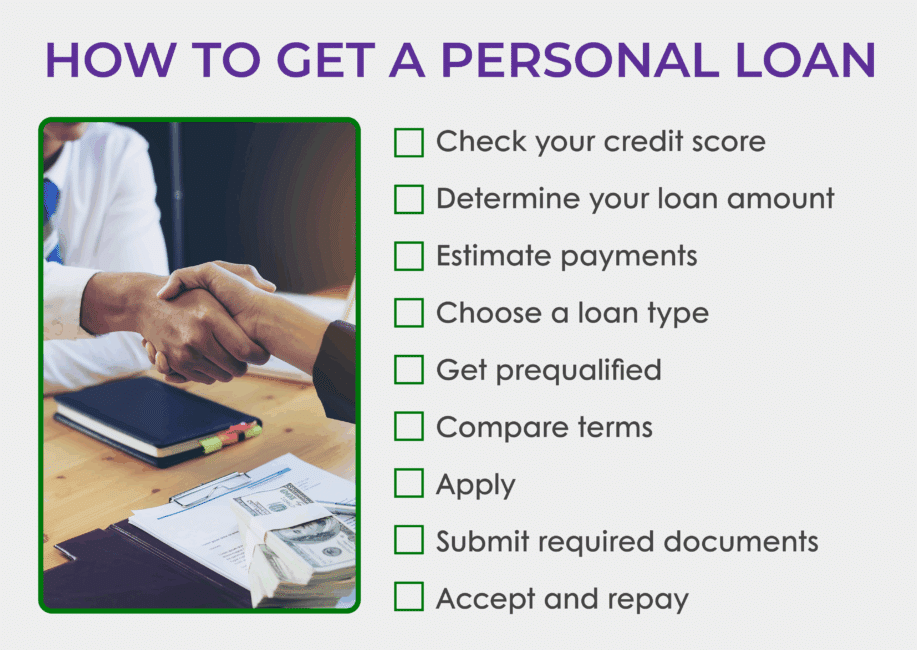

Taking out a personal loan can be a simple way to take care of your pressing needs in a timely manner. While applying for a personal loan is a fairly straightforward process, there are many things that you’ll want to know and consider before applying. We’ve put together this list of steps to guide you through the personal loan process.

Keep reading to learn how to get a personal loan from a bank or lender.

- 1. Check your credit score

- 2. Determine how much you need to borrow

- 3. Estimate your loan payments

- 4. Decide on a loan type

- 5. Get prequalified

- 6. Compare loan terms

- 7. Apply with your chosen lender

- 8. Provide the required documentation

- 9. Accept the loan terms and begin making payments

- Apply for a personal loan with confidence

1. Check your credit score

Checking your credit score before you apply for a loan will give you a better sense of what type of loan terms you’re likely to be offered. Your credit score is a three-digit number that shows lenders how well you handle money and pay back what you owe. It’s made up of several factors, including:

- Your payment history (whether you pay bills on time)

- Credit utilization (how much of your available credit is in use)

- Length of your credit history (how long you’ve had credit accounts)

Understanding your credit score is one of the first steps in getting approved for a loan.

Here’s how different score ranges can affect your loan:

- Excellent credit (740-850). You’ll likely get approved easily and receive the best interest rates and loan terms available.

- Good credit (670-739). You have a strong chance of approval and will qualify for competitive rates. However, they may not be the absolute lowest.

- Fair credit (580-669). You can still get approved, but you might get higher interest rates. This is because lenders may see you as more of a risk.

- Poor credit (300-579). Getting approved becomes much harder. If you do qualify, you’ll pay high interest rates and may need to provide additional documentation. If your credit score is low, consider building your credit before applying for a loan.

While your credit score is important, it’s not the only thing loan companies consider. Other key factors lenders often review are:

- Income and employment

- Debt-to-income ratio

- Employment history

2. Determine how much you need to borrow

Before you contact any lenders or learn how to take out a personal loan, it’s always a good idea to figure out how much money you need to borrow. Then, review your finances to ensure you can afford to pay off the loan on time.

When determining how much you can afford to pay, you’ll need to factor in a few things. Some lenders charge an “origination fee” upfront to cover the cost of processing a new loan. This is additional money that you’ll need to pay in addition to the loan itself and the interest on the loan. So, you may need to set aside extra money to pay this fee at the beginning of your loan. (Note: Sun Loan does not charge origination fees.)

3. Estimate your loan payments

You’ll then need to use a personal loan calculator to estimate your monthly loan payments. While the monthly payment amount can vary due to different interest rates and lender terms, it’s best to have a rough sense of how much it will be. This also won’t provide you with an exact amount, but it will prepare you with a range.

4. Decide on a loan type

It’s time to explore your loan options and figure out the type that’s right for you. There are different types of personal loans available, each designed for different needs.

While some loans, like personal installment loans from Sun Loan, can be used for nearly everything, other types of loans are only granted for specific needs.

Here are some of the ways you would be able to use a personal installment loan:

Debt consolidation

Taking out a personal loan to cover other debts allows you to simplify the number of payments you have to make each month. Doing so may also result in paying less total interest than you would have if you had several different sources of debt.

Home improvement

A personal loan can be a good choice when funding a home renovation. It may not require you to secure the loan with a form of collateral (such as your house)

Emergency

If you need money to cover an unexpected expense like car repairs, an emergency loan can help.

Medical

A personal loan can help you pay for an unpredictable medical issue.

Vacations, weddings, and special events

Weddings and vacations can require an upfront payment. A personal loan is helpful in that it allows you to pay this money now and then pay it back slowly over time.

5. Get prequalified

Getting prequalified is an important part of learning how to obtain a personal loan. It can save you time and help you make better financial decisions. When you get prequalified, a lender does a quick review of your finances and tells you what kind of loan you might qualify for. This provides a preview of your potential interest rate, loan amount, and monthly payment without affecting your credit score.

It’s a good idea to get prequalified with several different lenders to compare offers side by side. One lender might offer you a lower interest rate, while another might have better repayment terms.

6. Compare loan terms

Once you have offers from different lenders, it’s time to compare them carefully. Don’t just look at the monthly payment amount. There are several important factors that can affect how much you’ll actually pay over the life of your loan.

Here’s what to compare when looking at loan offers:

- Annual percentage rate (APR). This is the total cost of your loan, including interest and most fees, all rolled into one number. A lower APR means you’ll pay less overall.

- Repayment terms. This is how long you have to pay back the loan.

- Monthly payment account. Ensure the payment fits comfortably within your monthly budget, allowing for unexpected expenses.

- Fees. Look for origination fees, prepayment penalties, and late payment fees. Some lenders charge these while others don’t.

- Loan amount. Check if the lender will give you the full amount you need or if you’ll have to settle for less.

- Customer service. Read reviews to see how the lender treats customers.

7. Apply with your chosen lender

Now that you know the first few steps for how to get a personal loan, it’s time to apply. Some lenders like Sun Loan let you complete the application process online, over the phone, or in person, while others limit you to a single option.

8. Provide the required documentation

Part of knowing how to apply for a personal loan is having your documents ready. Just like the application process can vary from one lender to the next, the documentation required for a loan can also vary. Loan companies commonly ask for the following information:

- Valid government-issued ID (driver’s license, passport, or state ID)

- Proof of income (recent pay stubs, bank statements, or tax returns)

- Employment verification (employer contact information or recent pay stubs)

- Proof of residence (utility bill, lease agreement, or mortgage statement)

- Social Security number

If you’re applying for a personal installment loan at Sun Loan, you’ll need a valid ID, proof of income, and proof of residence.

9. Accept the loan terms and begin making payments

Once approved by the lender, you’ll be required to accept the loan terms and sign the necessary paperwork. Be sure to read everything carefully and ask any final questions you might have. When the loan is finalized, you can receive payment as soon as the very same day. Congrats!

To avoid missing payments, it’s a good idea to mark on your calendar when the payments are due each month. You also might want to set up automatic payments.

If your situation changes and you have more money available, it’s not a bad idea to pay more than the minimum monthly payment for your loan. By paying more than the minimum, you’ll decrease the total amount of interest that you pay on the loan over its lifetime.

Apply for a personal loan with confidence

Getting a personal loan isn’t complicated when you know what steps to take. By checking your credit score, figuring out how much you need, shopping around with different lenders, and comparing loan terms, you’ll be ready to make the best choice for you.

At Sun Loan, we make the process of getting a personal loan simple. We look at more than just your credit score and offer flexible application options. With quick approval times, we’re ready to help you get the money you need when you need it.

Ready to take the next step? Apply for a personal installment loan with Sun Loan today.